Automated Tax Calculations : Streamline tax calculations for accurate and efficient processing.

Optimize Your Tax Planning and Filing with AI Precision

Simplify Tax Processes and Ensure Compliance

with AI-Driven Solutions

Revolutionize Tax Management with AI

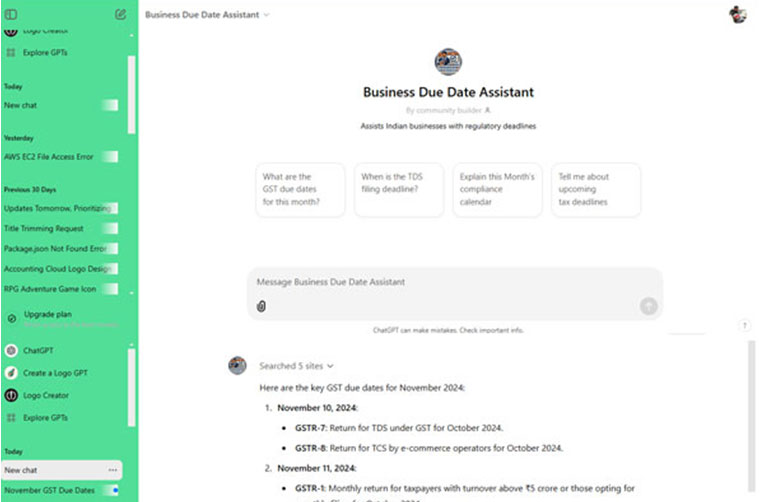

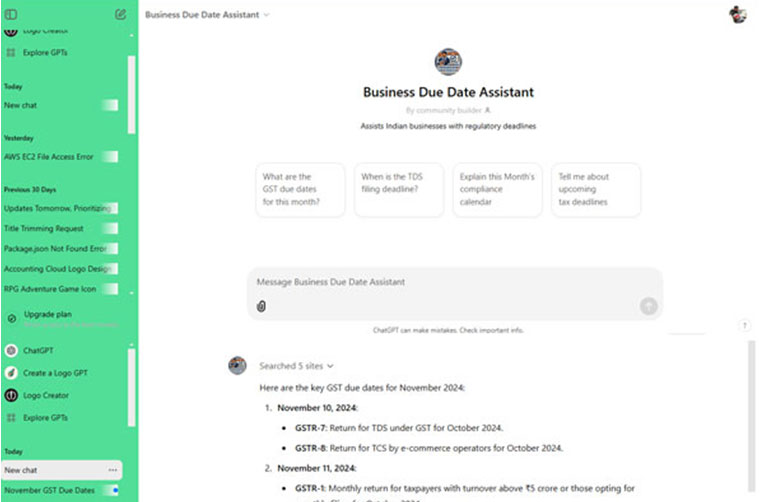

Transform the way you manage taxes with AI-powered solutions. Our Taxation GPT automates tax calculations, monitors compliance, and ensures timely filings, empowering businesses to optimize tax strategies, reduce liabilities, and stay ahead of evolving regulations. Let AI handle the complexity, so you can focus on your business growth.

Key Features

Key Features of AI-Powered Tax Solutions

-

-

Tax Compliance Monitoring : Stay updated on compliance requirements to avoid penalties.

-

Filing Reminders and Assistance : Get timely reminders and support for filing taxes accurately.

-

GST Reconciliation : Match purchase registers with GSTR-2A for accurate ITC claims.

-

Capital Gains Calculation : Calculate gains from investments such as stocks, mutual funds, and real estate.

-

Advance Tax Suggestions : Get proactive recommendations for advance tax payments.

Benefits

Benefits of AI-Driven Tax Management

-

Accurate Tax Filings : Eliminate errors and ensure compliance with tax regulations.

-

Timely Compliance : Avoid penalties by staying on top of deadlines with automated reminders.

-

3. Reduced Tax Liabilities : Optimize tax strategies to minimize liabilities and maximize savings.

-

Increased Efficiency : Save time by automating recurring tax processes.

-

Comprehensive Support : Manage direct and indirect taxes effortlessly with AI assistance.

Taxation GPT FAQs

Can Taxation GPT handle both direct and indirect taxes?

Yes, it supports tasks like ITR filing for direct taxes and GST reconciliation and filing for indirect taxes.

How does Taxation GPT help in tax savings?

It provides tailored recommendations for tax-saving investments based on your income and financial goals.

Does Taxation GPT support individual tax filings?

Yes, it caters to both individuals and businesses, automating calculations and ensuring compliance with applicable laws.

Can Taxation GPT integrate with accounting software?

Yes, it integrates seamlessly with popular accounting tools, allowing smooth data flow for tax calculations.

How does Taxation GPT ensure compliance with changing tax laws?

It stays updated with the latest tax regulations and provides real-time alerts and adjustments to calculations.

Ready to transform your financial operations?

Contact us today to schedule a consultation and discover

how our AI-powered solutions can benefit your business.